The formula to calculate how much leverage yield as an investor you can garner when you rent out your property can be represented by this generic formula. Return on Assets d.

/318fd1c560d72df660125152d9538c54-94be4c876080468c9301fe9617b86057.jpg)

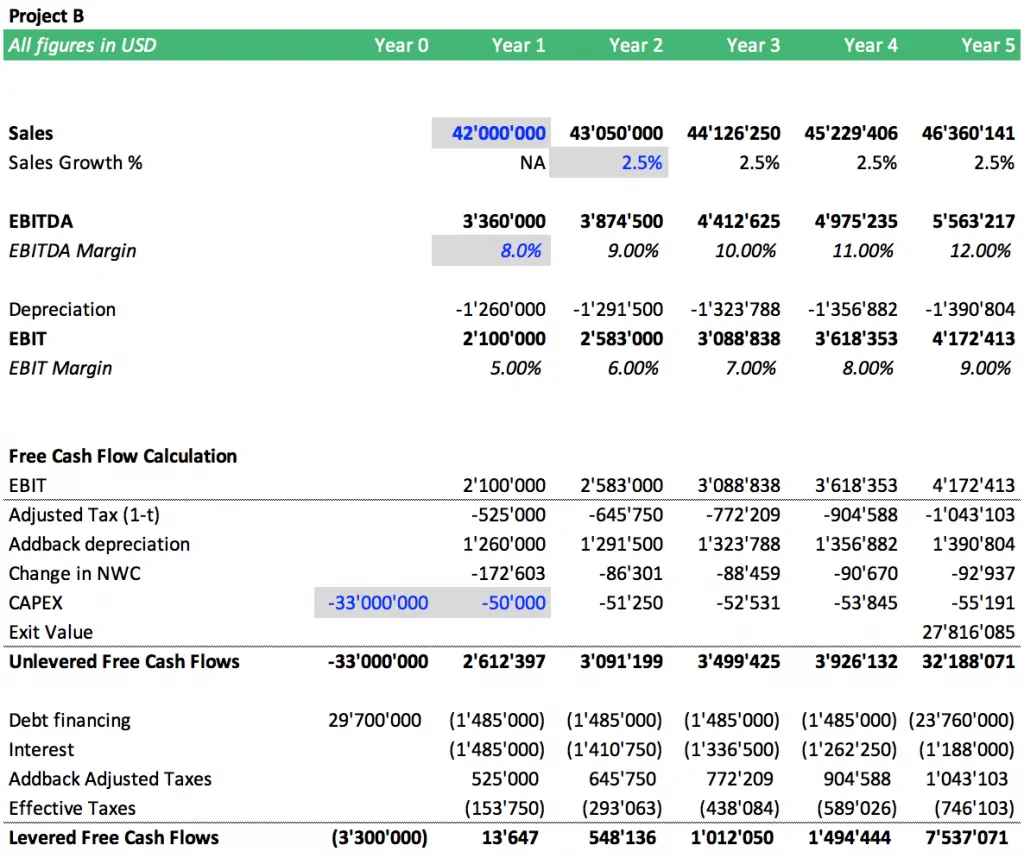

Levered Free Cash Flow Lfcf Definition

Net Income to Free Cash Flow.

De levered net income formula. What is the formula for de-levered net income. FL Debt Debt Equity. C Cost of borrowing eg.

Net Income 1-txInterestExpense. Abbreviated it looks like this. Using Levered Free Cash Flow the formula is Net Income DA NWC CAPEX Debt.

Options A and B are incorrect because they assume that financial leverage can have only one effect either an increase or a decrease in net income and return on equity. Net Income 28800. One can refer to the above income tax slab table for this.

De-levered net income net income interest expense x 1-tax rate However ROE should use levered net income instead as you want to take into account the effect of leverage. Calculating free cash flow from net income depends on the type of FCF. N owner have to put down.

Heres what each of these means. L R 1-NCN. Financial leverage increases the variability of a companys net income and return on equity and may result either in an increase or decrease of the two.

Add your answer and earn points. Using Unlevered Free Cash Flow the formula is Net Income Interest Interesttax rate DA NWC CAPEX. Which of the following ratios use de-levered net income.

FL Debt Total Assets. Therefore when analysing ROE and all its component consider the effect of leverage. Levered free cash flow earned income before interest taxes depreciation and amortization - change in net working capital - capital expenditures - mandatory debt payments.

L Leveraged Return. Net Income Total Revenue Total Expense. Deleveraging is when a company or individual attempts to decrease its total financial leverage.

Net income formula. Rental yield yield on bond. Return on Equity c.

Relevance and Uses of Taxable Income Formula. Multiply the total from Step 2 by one times the tax rate 10 x tax rate to arrive at the unlevered net income amount. Unlevered Free Cash Flow is used in.

The simplest way to think about the ROI formula is taking some type of benefit and dividing it by the cost. Formula to Calculate Degree of Financial Leverage. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made.

The formula of financial leverage is as follow. Interest from bank. Return on Sales 1 See answer kasier8085 is waiting for your help.

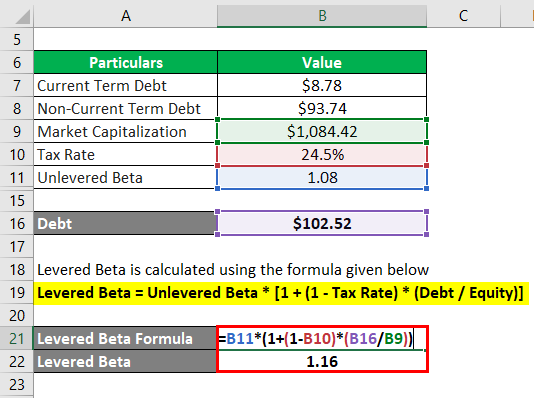

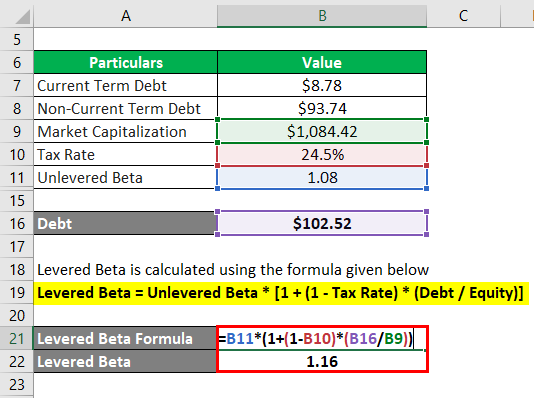

Hence in order to take out the impact interest expense when computing return on assets an adjusted net income known as de-levered net income is computed using the below formula. The net income is a simple formula which. Net Income Margin IQ_NI_MARGIN Revenue Estimate IQ_REVENUE_EST SP Security Rating Action IQ_SP_ISSUE_ACTION Levered Free Cash Flow Margin IQ_LFCF_MARGIN EBITDA Estimate IQ_EBITDA_EST Accounts Receivable Turnover IQ_AR_TURNS EBIT Estimate.

R Yield on asset eg. De-levered net income equals net income plus 1 minus the tax percentage multiplied by the interest expense. Degree of financial leverage formula calculates the change in net income occurring because of change in earnings before interest and taxes of the company.

LFCF EBITDA - change in net working capital - CAPEX - mandatory debt payments. The look thru rule gave qualifying US. Total Taxable Income or Net Income Gross Total Income Deductions Exemptions allowed from Income.

A complex provision defined in section 954c6 of the US. After finding the net income based on under which Income range slabs the amount comes the Taxes are calculated. Leveraged Yield Formula.

It is clear that Total Assets Debt Equity So. Some people refer to net income as net earnings net profit or simply your bottom line nicknamed from its location at the bottom of the income statementIts the amount of money you have left to pay shareholders invest in new projects or equipment pay off debts or save for. The LFCF formula is as follows.

De - levered net income The size of a tax shield in a given period is equal to 1-tax rate x interest payment tax rate x interest payment tax rate x Debt 1-tax rate x. Net Income 1-txInterestExpense. Net income is your companys total profits after deducting all business expenses.

This is not the case. Unlevered Free Cash Flow Operating Income 1 Tax Rate Depreciation Amortization - Deferred Income Taxes - Change in Working Capital Capital Expenditures Why do we ignore the Net Interest Expense Other Income Expense Preferred Dividends most non-cash adjustments on the Cash Flow Statement most of Cash Flow from Investing and all of Cash Flow from Financing. Levered free cash flow is calculated as Net Income which already captures interest expense Depreciation Amortization - change in net working capital - capital expenditures -.

The most direct way for an entity to deleverage is to. ROI Net Income Cost of Investment. It helps in determining how sensitive the profit of the company is to the changes in the capital structure.

Internal Revenue Code that lowered taxes for many US. Net Income 50000 15000 5000 1200 Net Income 50000 21200. Tips If you do not have the EBIT amount yo can take the annual sales amount and subtract cash costs and depreciation to arrive at the EBIT figure.

ROI Investment Gain Investment Base. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business. The first version of the ROI formula net income divided by the cost of an investment is the most commonly used ratio.

If the total assets of the company are 100 its debt amounts 50 then its financial debt is 50 50100. Net Income of the company is calculated using below formula-.

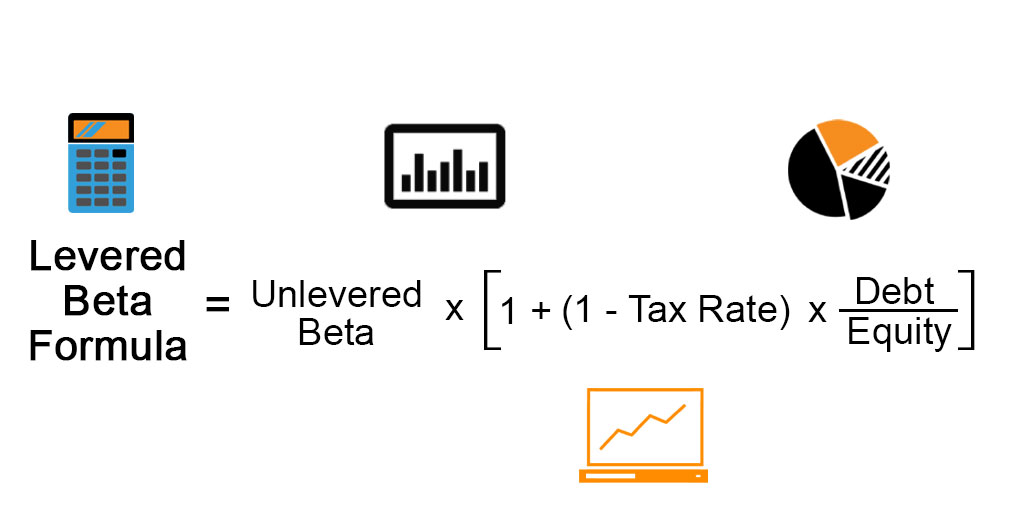

Levered Beta Formula Calculator Examples With Excel Template

Types Of Lease In 2021 Business Tax Deductions Finance Investing Accounting And Finance

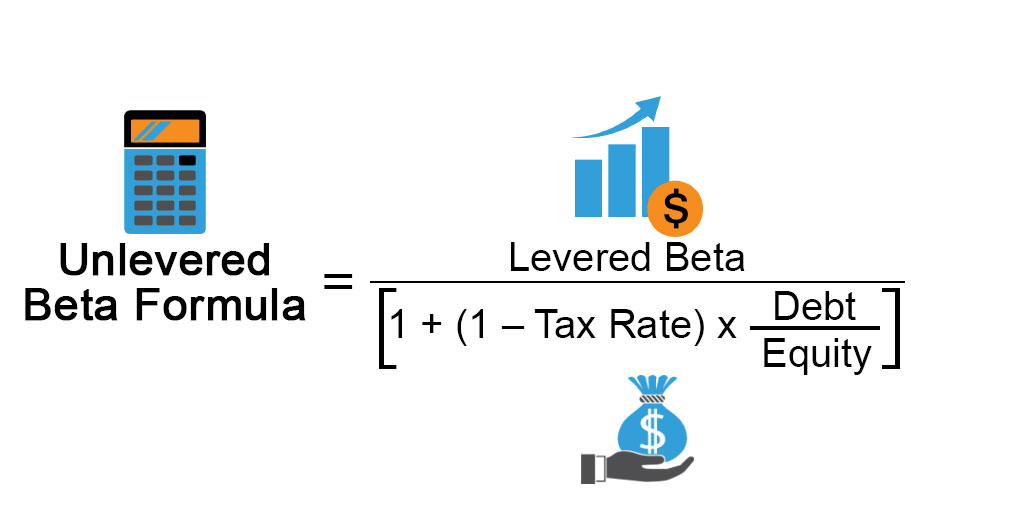

Unlevered Beta Formula Calculator Examples With Excel Template

Levered Beta Formula Calculator Examples With Excel Template

Irr Levered Vs Unlevered An Internal Rate Of Return Example Efinancialmodels

Debt Ratio Debt Ratio Bookkeeping Business Financial Life Hacks

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Formulas Calculations And Full Tutorial

Unlevered Free Cash Flow Definition Examples Formula